The US franchise sector continues to thrive in 2026, with franchise ownership contributing significantly to job creation and economic output.

According to the International Franchise Association, franchising is expected to generate over $860 billion in economic output this year alone.

This growth is driven by consumer demand, scalable business models, and an increase in entrepreneurs seeking structured pathways to business ownership.

Investing in franchises is no longer just a fallback for those leaving the corporate world. It’s a strategic move for investors seeking long-term profitability, passive income, or a family-run venture.

From fast food and fitness to tech support and senior care, the franchise opportunities available in today’s market are as diverse as the entrepreneurs pursuing them.

This franchise investment guide will walk you through everything you need to know before jumping into the world of franchise ownership.

In this article:

Understanding Franchise Models

Before making a franchise investment, it’s essential to understand the different franchise business models. Each model comes with its own set of responsibilities, risks, and rewards.

Single-unit, multi-unit, and master franchises

- Single-unit franchises are ideal for first-time investors. You own and operate one location, allowing you to get hands-on experience while minimizing risk.

- Multi-unit franchises involve owning multiple locations, either all at once or over time. This model suits those looking for scalability and larger profits.

- Master franchises grant rights to develop and sell franchises within a specific territory. They require a high investment but offer significant returns if executed well.

Home-based vs. brick-and-mortar franchises

- Home-based franchises typically involve services like consulting, travel planning, or cleaning. They offer low overhead costs and greater flexibility.

- Brick-and-mortar franchises, such as restaurants or gyms, require physical locations and higher startup costs but can yield substantial revenue with the right market.

Initial Costs vs. Long-Term Profitability

Franchise investment amounts vary widely depending on the industry, brand, and business model. Here’s a basic breakdown:

- Under $50,000: Includes many home-based franchises such as mobile cleaning services, tutoring, and travel agencies.

- $100,000–$250,000: Covers food trucks, fitness studios, and mid-sized service-based franchises.

- Over $500,000: Includes high-end restaurants, hotels, and large retail operations.

ROI Timelines by Industry

- Food and beverage: Typically, 2–5 years to break even due to high initial costs and operational expenses.

- Home services and cleaning: ROI can be seen in 1–3 years thanks to lower overhead and ongoing demand.

- Senior care: Often profitable within 2–4 years, as demand for elderly services continues to rise.

- Fitness franchises: Vary widely, with boutique studios recovering faster than large gyms.

Always account for ongoing royalty fees, marketing contributions, and operating expenses when calculating profitability.

Top Franchise Industries in the US

Certain industries consistently lead the pack in franchise performance. Here’s a look at the most promising sectors in 2026:

1. Food and beverage

Still the most popular category, food franchises, from quick-service to fast-casual, they offer powerful brand recognition and consistent foot traffic.

2. Home services

Franchises offering plumbing, electrical, HVAC, and landscaping services are in high demand due to growing homeownership and aging infrastructure.

3. Senior care

With an aging population, senior care franchises are booming. Services range from in-home care to assisted living placement.

4. Fitness and wellness

Health-conscious consumers continue to drive growth in boutique gyms, yoga studios, and wellness coaching.

5. Cleaning services

Both residential and commercial cleaning franchises have proven resilient during economic downturns and pandemics.

6. Emerging sectors

Franchises in digital marketing, pet services, and eco-friendly solutions are gaining traction with modern consumers and investors alike.

Risks and How to Mitigate Them

Like any investment, investing in franchises comes with risks. The key to success lies in awareness and due diligence.

Common franchise investment mistakes

- Ignoring the FDD: The Franchise Disclosure Document (FDD) contains vital information about the franchisor’s financial health, litigation history, and support systems. Failing to read and understand it is a costly mistake.

- Underestimating total costs: Many investors focus solely on the franchise fee, overlooking operational costs, build-out expenses, and required reserves.

- Choosing based on trendiness: Popular doesn’t always mean profitable. Ensure the franchise is sustainable long-term.

Evaluating Franchise Disclosure Documents (FDDs)

Aspects to look out for:

- Item 7: A breakdown of initial and ongoing costs.

- Item 19: Financial performance representations (if provided).

- Litigation history: Frequent lawsuits may be a red flag.

- Franchisee turnover rate: High turnover can indicate systemic problems.

Consult with a franchise attorney to interpret complex sections and negotiate the terms.

How to Choose the Right Franchise

A successful franchise investment is not just about picking a profitable business. It’s about finding the right fit.

Align with your skills and goals

- Are you hands-on or more of a manager?

- Do you want to build an empire or run a lifestyle business?

- Are you passionate about the industry?

Franchise ownership should align with your personality, work ethic, and life goals. Talk to existing franchisees to gain insight into daily operations.

Research support systems

Opt for franchises that offer:

- Initial training

- Ongoing marketing and operational support

- Scalable systems

- Strong brand presence

Franchises with robust franchisor support are more likely to succeed.

Steps to Get Started

Ready to turn your franchise dreams into reality? Here are the essential steps to launch your franchise journey:

1. Research franchise opportunities

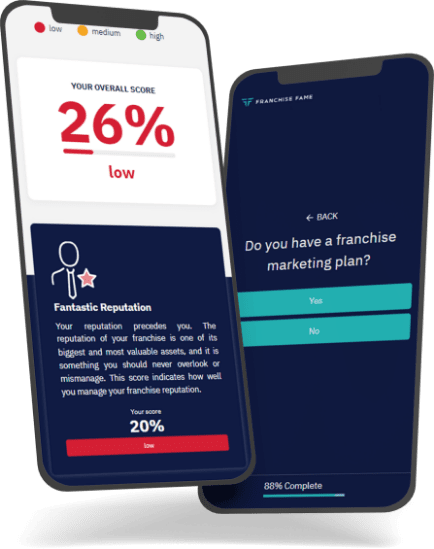

Use reliable platforms like Franchise Fame to compare franchise businesses by industry, location, and investment range.

2. Assess your finances

- Check your credit score.

- Determine how much capital you can invest.

- Explore funding options like SBA loans, home equity, or franchise financing companies.

3. Request and review the FDD

Once you shortlist franchises, request their FDDs and read them thoroughly. Speak to current and former franchisees listed in Item 20.

4. Meet the franchisor

Attend discovery days to meet the franchisor’s team, ask questions, and evaluate the culture and vision.

5. Consult professionals

Work with a franchise attorney and an accountant to understand legal and financial implications.

6. Sign the agreement

Once you’re satisfied, sign the franchise agreement and begin onboarding and training.

Conclusion

Franchise investment offers a unique blend of independence and support, making it an ideal path for aspiring entrepreneurs in 2026.

By understanding franchise models, assessing your financial readiness, and choosing an industry that matches your skills and goals, you can increase your chances of success.

Ready to explore the best franchise opportunities the US has to offer?

Visit the Franchise Fame listings today to find the ideal business opportunity tailored to your vision.