Investors in 2026 are pivoting from volatile equities to private assets that offer predictable cash flow. The ongoing search for “sticky” yields in a post-inflationary environment is a constant. So, where can investors find this golden opportunity? For me, it is and always will be franchising.

This shift is driven by a desire for “real economy” assets: businesses that provide tangible services and possess the inherent pricing power to withstand shifting macro-monetary policies.

Franchising has transcended its “small business” roots to become a scalable, professionalized, or “micro-PE” asset class, offering a unique blend of operational control, recurring revenue, and recession-resilience.

The model essentially allows an investor to buy into a “proven beta” while applying their own management alpha to drive superior returns.

This is where Franchise Fame steps in as the bridge for high-net-worth investors looking for US franchise opportunities. As one of the primary gateways for US-market due diligence, I’ve created the “Five Fs of Franchise Marketing” framework as a lens through which savvy investors should evaluate these assets. Interested in finding out more? Keep reading below.

In this article:

- The Institutionalization of the Franchising Sector

- Yield, Cash Flow, and the Inflation Hedge

- Due Diligence and Risk Mitigation

- High-Growth Verticals for 2026

- Portfolio Construction & Exit Strategies

- The “Finding the Fit” Framework

- Challenges and Regulatory Realities

- The Strategic Necessity of Franchising

The Institutionalization of the Franchising Sector

J.P. Morgan’s Alternative Investments Outlook 2026 shows that major firms are moving from individual unit ownership to buying entire regional systems. Multi-Unit, Multi-Brand portfolios (MUMBOs) are the new cool kid on the block, and professional investors are buying entire regions rather than individual stores.

This consolidation play allows for “back-office” centralization, where a single HR and accounting department can service 50 locations, dramatically boosting EBITDA margins.

This heightened interest means that the sector is becoming increasingly professionalized and is seeing an influx of capital from major private equity firms. Also worth highlighting are the shifts in franchising to professional management models.

Today, we’re seeing a rise of “absentee” and “semi-passive” structures that allow investors to scale without daily operational involvement. I call this the asset-light advantage: franchisor models (which are royalty-based) provide high-margin, low-capex exposure for investors.

For the institutional investor, this mirrors the appeal of a software-as-a-service (SaaS) model, defined by high recurring revenue with limited physical overhead at the corporate level.

Yield, Cash Flow, and the Inflation Hedge vs. Traditional Portfolios

2026 data shows that diversified franchise portfolios delivered up to 220% higher total returns than managed stock portfolios or traditional 60/40 portfolios. The performance gap is evident, and franchising is a clear winner.

When public markets face multiple compressions, franchise assets often maintain their valuation because they are appraised on hard cash flow rather than speculative future growth.

Also, we need to talk about inflation protection. For example, with franchising, the “royalty on gross sales” model creates a natural hedge by capturing real-time price increases. Over a period of 10 years, it’s becoming evident that franchise portfolios have delivered total return on investment (ROI) between 249% and 341% over the period.

What about tax optimization? I think that the levels of depreciation and business expense benefits appeal to high-net-worth individual (HNWI) investors. But how does franchising do all this?

The innate ability of a national brand has the power to pass on supply chain costs without losing market share. In other words, franchise brands can pass on costs to consumers more effectively than independent businesses due to brand equity and “buying power.”

Due Diligence and Risk Mitigation in a Modern Market

Now, let’s dive a little deeper into due diligence and risk mitigation with franchising. It’s common knowledge that Franchise Disclosure Documents (FDDs) exist to inform a prospective investor. However, today, the standardization of the audit process for franchise disclosure documents and operations manuals as if they were corporate prospectuses serves as the “insurance policy” for capital.

The modern market of today is also offering greater assistance with site selection. Artificial intelligence (AI) and mobility data have de-risked the “next location” decision. But that’s far from all.

The use of predictive maintenance and agentic customer support to preserve margins is another big area that gives greater assurance. By utilizing AI “agents” to handle initial customer inquiries and lead nurturing, franchisees can maintain 24/7 responsiveness without the prohibitive cost of 24/7 labor.

And as “safety seekers” look to minimize risk, conservative institutional money is moving toward non-discretionary services. The safety net that franchises provide through established FDDs and supply chain stability, among other things, really does prove that there’s a lower failure rate in franchising than in independent startups.

In the institutional world, we view this as “buying the moat” that a startup would spend years trying to build.

To end this section, I’d like to touch on my Five Fs model. I’ve created a proprietary framework for institutional-grade vetting, which sees a franchise’s reputation as the brand’s most valuable intangible asset for capital preservation. With so much effort exerted by franchise brands to maintain global and local levels of consistency in marketing efforts, franchising is really a no-brainer.

High-Growth Verticals for 2026

Home services (HVAC, restoration), senior care, health and wellness, early childhood education, and pet wellness are outperforming discretionary retail. Why? Because these are recession-resistant verticals. I like to call these sectors “blue-collar gold”. Investors are realizing that while technology changes, the need for a leaking pipe to be fixed or a senior to be cared for remains constant, regardless of the economic climate.

Other areas that are thriving and I foresee will continue to thrive include specialty food and automation. There’s a clear shift toward smaller footprints, such as drive-thrus and kiosks, to optimize ROI.

These “small-box” formats reduce rent expense (which was traditionally a franchise’s highest fixed cost), thereby lowering the break-even point and accelerating the path to profitability.

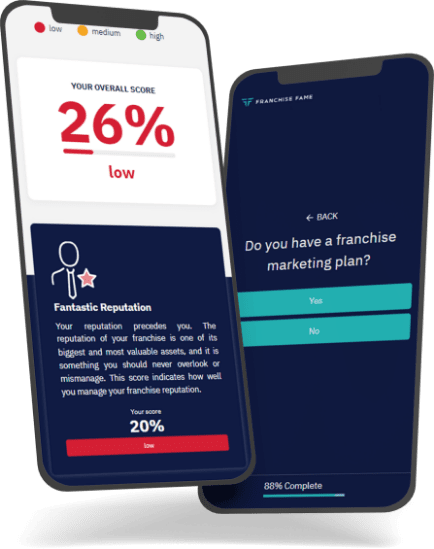

To add to this, I’m seeing a rise in the use of Enterprise artificial intelligence (AI) solutions to lower labor costs and protect unit-level economics. Today, finding the perfect match between investor profile and sector-specific cash flows doesn’t have to be a time-consuming challenge. At Franchise Fame, we’ve created a quick three-minute quiz to find your perfect franchise match.

Portfolio Construction & Exit Strategies

Franchisors that build Multi-Unit, Multi-Brand Portfolios (MUMBOs) are attracting strategic acquirers. There’s a strategic reason behind this, and that is that a five- to seven-year hold in a franchise portfolio mirrors the lifecycle of a traditional private equity fund.

The goal is often “arbitrage” or buying individual units at a 3x–5x EBITDA multiple and selling the aggregated portfolio at an 8x–12x multiple to a larger institutional buyer.

The “Finding the Fit” Framework

Now, I’d like to shift focus to franchisors by introducing you to my “Five F’s” model. The Five Fs of franchise marketing that I refer to in my book are: Fantastic reputation, Focused team, Franchise network, Full funnel, and Finding the fit.

Each “F” serves as a critical pillar; for instance, a “Full Funnel” ensures that the brand isn’t just generating leads, but is nurturing them with the high-touch engagement necessary to convert high-quality partners.

Regarding the last “F”, franchise brands that apply a high-level vetting process for potential investors are much more likely to find suitable investors, candidates, and partners for the business. This is where the interest of the franchisor and the investor align: both want a partner with the capital and the character to uphold the brand’s premium standing.

Such a strategic selection process using the Franchise Fame data-driven insights screens candidates for institutional-grade potential. It’s a franchisor’s way of performing due diligence.

Challenges and Regulatory Realities

I’m not going to sugarcoat it: investing in franchising is an important step. Franchises that want to attract the right candidates must be aware of the extreme importance of legal transparency and regulatory readiness in the 2026 space.

Compliance is not a hurdle. It is a competitive advantage. Brands that exceed regulatory requirements often command higher valuation multiples because they represent a “lower-risk” acquisition for future buyers.

And when it comes to liquidity timeframes, it’s key that franchisors and investors have clearly managed expectations regarding exit strategies. While returns are high, the exit timeline is typically 12-18 months for a portfolio sale.

Investors must account for this “illiquidity premium”: the higher returns you receive in exchange for not being able to sell your asset at the click of a button, like a public stock. Also worth bearing in mind is the five- to seven-year investment horizon typical of professional portfolios.

The Strategic Necessity of Franchising

Franchising is no longer an “alternative” to be ignored. It is a strategic necessity for a diversified 2026 portfolio. I encourage you to evaluate the Franchise Fame US directory as a tool for your next allocation and to view real-time market entries.

By moving beyond traditional equities and embracing the “franchise-as-a-service” model, investors can secure their financial future in an increasingly unpredictable world. For me, 2026 will be a year of success for investors who see franchising as a scalable, professionalized asset class.