The Bank of England recently announced that the UK economy is predicted to shrink in the last three months of this year. This negative growth is expected to last until the end of 2023. So what does this mean for individuals and business owners? Apart from the emotional upheaval of uncertainty, negative economic growth affects the cost of living such as food and energy prices. And to top it all off, we’ve just come out of Covid-19 lockdowns only to have the conflict in Ukraine start and shake up the world. Despite all this gloom and doom, there is a light at the end of the tunnel. There are several very good reasons to invest in a franchise during a recession. Wondering what they are? We take a closer look.

Table of contents:

- What is a recession?

- Why choose recession-proof franchises?

- A proven business model

- Benefit from an unlimited support network

- It’s less risky than a startup

- Gain access to technology and training

- Marketing and advertising assistance

- It can be much more affordable than a startup

- You’re your own boss

- What industries do well in a recession?

- Concluding remarks

What is a recession?

Before delving into the reasons why you should invest in a franchise business during a recession, it’s important first to explore what a recession is. In short, it is considered negative economic or gross domestic product (GDP) growth that lasts for at least two consecutive quarters.

Some recession causes include:

- a decline in industrial and business activity,

- major spikes in oil prices,

- political tensions and upheaval in the world and more

All of these can lead to inflation and high costs of living, and may even result in redundancies and higher levels of unemployment, among others.

The best advice you’ll get is to be prepared for a recession before it begins. This way, you’ll pad your nest with the right resources to see you through the tough times. But how can you do this? The answer lies in investing in recession-proof franchise opportunities. Wondering why we suggest this? Take a look below.

Why choose recession-proof franchises?

As a developed region, it might be surprising to find out that there are only around 1,000 active franchise systems in the UK. This is considerably lower than many other countries around the world. This not only creates new business opportunities but also enables you to enter an industry that you’re comfortable with and that is recession-proof.

Entering the world of franchising is one way of helping you figure out how to recession-proof your business. Here are some other reasons why you should consider franchising as an option:

1. A proven business model

Franchises are franchises because of their past successes. A business owner has developed their business from the ground up, replicated this business model in various territories, tried and tested new ideas – all this to find the winning formula for ensuring that the business succeeds in good times and in bad. What’s more, with a franchise, you can benefit from the franchisor’s reputation when you approach a lender for financial support as lenders tend to favour franchise businesses over independent start-ups. The reason for this is simple: franchise business models are reputable, strong, resilient and more adaptable than others.

2. Benefit from an unlimited support network

One of the biggest risk factors for anyone starting their own business is the fact that they are completely on their own. You will not have anyone to advise you on strategies going forward, how to deal with tough times or anything else related to your business.

A franchise business is different. You not only get support from your franchisor from day one, but you also benefit from the support of the entire franchisee network, which consists of other business owners who’ve been through your situation and can help offer advice and strategies for addressing problems as they arise.

3. It’s less risky than a startup

Running a franchise operation is less risky than a startup. This is due to a variety of factors including the fact that you benefit from the franchisor’s established brand name in the industry, you can take advantage of a pre-existing clientele and customer base in your designated, geographically-defined area and so much more. As a result, lenders are much more likely and willing to help a new franchisee with financial resources than a riskier, independent business.

4. Gain access to technology and training

A franchisor will want to ensure that each new franchisee comes on board ready and trained to pick up the business model and run with it for financial success. As a result, franchisors offer access to their technological know-how, tools and software as well as training to make sure you get off to a great start.

What’s more is that even if you don’t have prior experience in the industry you’d like to join, in most cases, the training provided will take care of this issue and you can even purchase your franchise business by following a semi-absent franchise model.

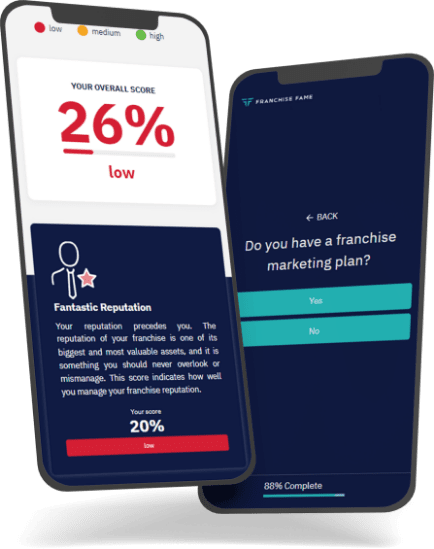

5. Marketing and advertising assistance

A further benefit of buying a franchise in a recession, apart from the established brand and industry reputation of the franchisor, is the fact that you’ll get marketing and advertising assistance. While many startups have separate marketing departments, franchisors have an integrated marketing and advertising arm that ensures brand consistency across all platforms. This means that either your role in marketing and advertising to your clients will require minimal input from you, or you’ll get full support with marketing materials going forward. This eliminates one more worry for you as you start out.

6. It can be much more affordable than a startup

Raising a startup business from the ground up requires a lot of time, effort and financial resources. However, with franchising, you don’t have to pay an arm and a leg in order to get started. There are multiple low-cost franchise opportunities available for you to explore that will suit your budget. And the best part is that most of these opportunities offer high returns on your investment.

7. You’re your own boss

Finally, as a franchisee, you’re your own boss and you’re in control of the daily operations of the business. You will take charge of decision-making and if any support is needed, you can always reach out to the franchisor to help you get from point A to point B effortlessly. Remember that you can always count on franchise support, which is something an independent startup will not have.

What industries do well in a recession?

Nonessential goods are the first thing consumers cut back on during a recession. Consumer discretionary goods and services, like fashion retail, entertainment, leisure, and beauty services are usually at risk of being affected.

As for recession-proof franchise ideas, you can always opt for franchises that operate in home care, deliveries, grocery retail, technology, healthcare, cleaning and other essential services. This should answer the question of what businesses do well in a recession.

Concluding remarks

A recession can be looked at as a scary time in one’s life because resources are limited and opportunities are minimal. Although no industry is 100% recession-proof, franchises have proven to have weathered many an economic storm to see them to success.

As a result, this is certainly a worthwhile consideration that you should give serious thought to as you evaluate your options on how to weather the upcoming economic downturn.

If you are interested in investing in a franchise business, take a look at all the opportunities we have available in our franchise directory and decide which one is best for you.